Introduction: The Heartbeat of the Digital Age

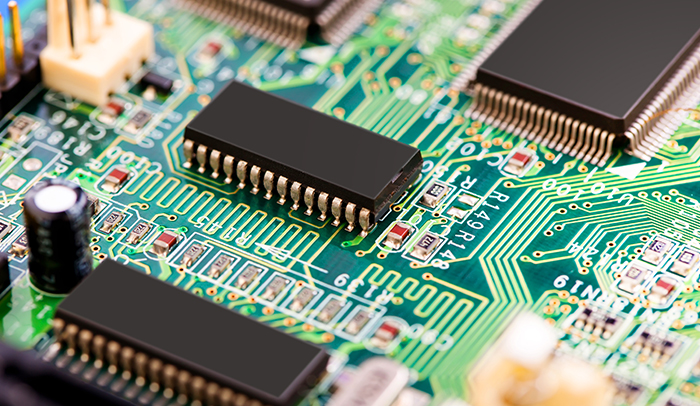

In the 21st century, semiconductors have become the invisible yet indispensable foundation of global civilization. Every smartphone, computer, electric vehicle, medical device, and even modern weapons system relies on these tiny chips. The semiconductor industry is not merely a sector of the global economy; it is the nervous system of the digital world.

The rise of semiconductors tells a story of relentless innovation, intense geopolitical rivalries, and profound shifts in the global balance of power. To understand why semiconductors occupy the very center of strategic competition today, we must retrace their journey—beginning with the invention of the transistor in the mid-20th century, through the silicon revolution, the globalization of chip production, and finally the emergence of a fragile but critical global supply chain.

I. The Birth of the Semiconductor Era (1947-1970)

1. The Transistor Revolution

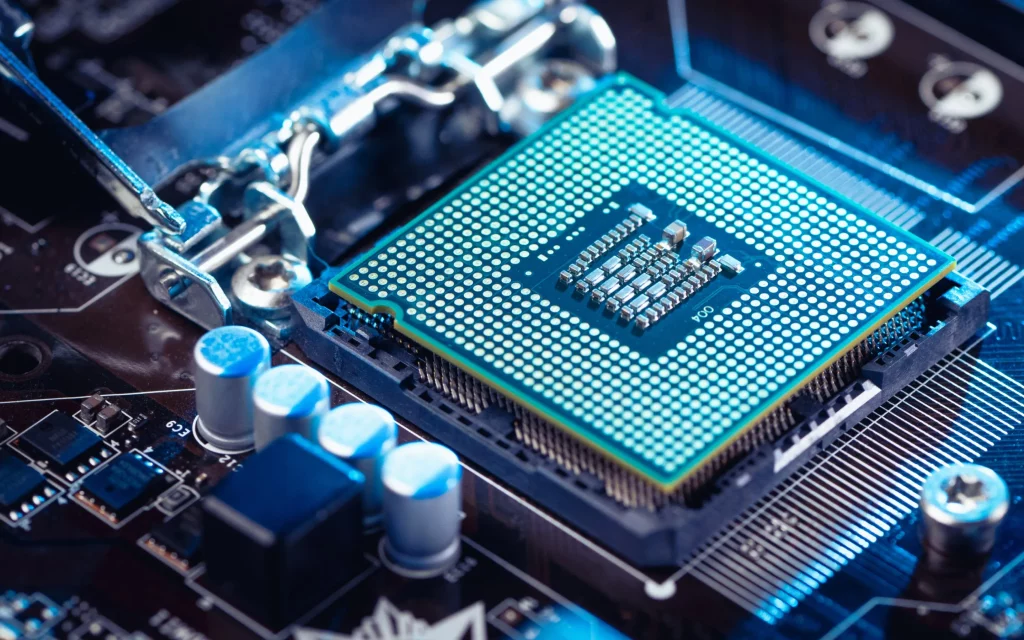

The story begins in December 1947, when John Bardeen, Walter Brattain, and William Shockley at Bell Laboratories invented the first working transistor. This tiny device could amplify electrical signals without relying on bulky and fragile vacuum tubes. The transistor’s small size, durability, and low power consumption made it the building block for all future electronic devices.

This discovery quickly became a cornerstone of U.S. post-war technological leadership. By the mid-1950s, military applications—such as missile guidance systems—were already integrating transistors. In 1956, the three inventors were awarded the Nobel Prize in Physics, cementing the transistor’s place in history as one of the most transformative inventions of the 20th century.

2. The Integrated Circuit and the Silicon Revolution

The next breakthrough came in 1958-1959 with the invention of the integrated circuit (IC) by Jack Kilby at Texas Instruments and Robert Noyce at Fairchild Semiconductor. By embedding multiple transistors on a single silicon wafer, the IC drastically reduced the size, cost, and power needs of electronic devices.

This period also saw the emergence of Silicon Valley as a hub for semiconductor innovation. Robert Noyce and Gordon Moore would go on to found Intel in 1968, setting the stage for an industry that would grow exponentially according to what became known as Moore’s Law—the observation that the number of transistors on a chip doubles approximately every two years, driving exponential increases in computing power.

II. Globalization and the Rise of Asian Powers (1970-2000)

1. Japan’s Semiconductor Ascendancy

In the 1970s and 1980s, Japan emerged as a formidable force in the global semiconductor industry. Backed by strong government-industry collaboration, Japanese firms such as NEC, Toshiba, and Hitachi dominated the production of memory chips (DRAMs). By the late 1980s, Japan held more than 50% of the world’s semiconductor market share.

This success prompted U.S. concerns about losing its technological edge. In response, the U.S. government formed SEMATECH, a public-private consortium, in 1987 to revitalize domestic semiconductor manufacturing. The U.S. also pressured Japan to open its markets and reduce alleged dumping of memory chips.

2. The Rise of South Korea and Taiwan

While Japan excelled in DRAM production, South Korea and Taiwan entered the semiconductor race in the late 1980s and 1990s. South Korean companies such as Samsung and SK Hynix leveraged aggressive investment strategies and government support to become dominant players in memory chips.

Taiwan’s unique contribution was the creation of the foundry model—pioneered by Taiwan Semiconductor Manufacturing Company (TSMC), founded in 1987 by Morris Chang. TSMC’s focus on contract manufacturing allowed fabless companies like Qualcomm, Nvidia, and later Apple to design chips without owning expensive fabrication plants. This innovation reshaped the global semiconductor ecosystem.

3. The U.S. Shift Toward Design Leadership

As manufacturing migrated to Asia, U.S. firms increasingly specialized in chip design. Companies such as Intel (for CPUs), Qualcomm (for mobile communications), Nvidia (for GPUs), and AMD became global leaders in innovation, while relying on Asian foundries for production. This division of labor—U.S. design and Asian manufacturing—created a highly efficient but also highly interdependent global supply chain.

III. The Geopolitical Stakes of Semiconductors (2000-2020)

1. China’s Strategic Catch-Up

In the early 21st century, China recognized semiconductors as a strategic priority. The government launched a series of industrial policies, including the 2014 National Integrated Circuit Industry Development Guidelines and the “Made in China 2025” plan. Massive investments flowed into domestic chipmakers such as SMIC and equipment/materials suppliers.

Despite progress, China still lags in the most advanced nodes—such as 7nm and below—due to heavy reliance on foreign lithography tools (notably ASML’s EUV machines) and EDA (Electronic Design Automation) software. This technological gap has become a focal point of U.S.–China tensions.

2. U.S.–China Technology Rivalry

Semiconductors are at the heart of the 21st-century strategic competition between the United States and China. Washington has imposed export controls on advanced chips and manufacturing equipment, citing national security concerns. Measures such as the 2022 CHIPS and Science Act aim to incentivize domestic semiconductor production and reduce dependence on Asia.

Beijing has responded with heavy investments in indigenous R&D and efforts to develop a self-sufficient semiconductor ecosystem. This rivalry has raised concerns about the potential “decoupling” of the global semiconductor industry.

3. The Vulnerable Supply Chain

The COVID-19 pandemic and subsequent global chip shortages (2020-2022) highlighted the fragility of the semiconductor supply chain. A disruption at a single fab in Taiwan or South Korea can ripple through industries worldwide, halting automobile production, delaying electronics launches, and even threatening defense readiness.

IV. The Advanced Manufacturing Race

1. Shrinking Nodes and Rising Complexity

As transistors shrink to the nanometer scale (5nm, 3nm, and soon 2nm), manufacturing requires extreme precision. The introduction of EUV lithography, produced almost exclusively by Dutch company ASML, has become a chokepoint for advanced manufacturing.

Building a state-of-the-art fabrication plant (fab) now costs over $20 billion and requires highly specialized knowledge, supply chains, and consistent power and water supplies. This enormous capital intensity has further concentrated production in a few companies, notably TSMC, Samsung, and Intel.

2. Geographic Concentration and Strategic Risks

Over 90% of the world’s most advanced chips are manufactured in Taiwan. This geographic concentration poses significant geopolitical risks, especially given tensions in the Taiwan Strait. Efforts to diversify production—such as new fabs in the U.S., Japan, and Europe—are underway but will take years to materialize.

V. Semiconductors as the New “Oil”

The comparison of semiconductors to oil is not merely metaphorical. Just as oil powered the industrial age, chips power the information age. Countries that lead in semiconductor technology hold leverage over others—economically, militarily, and diplomatically.

Energy security once defined geopolitical alignments in the 20th century; chip security increasingly defines them in the 21st. Nations are rethinking industrial policy, forming alliances, and sometimes engaging in outright techno-nationalism to secure access to this vital resource.

VI. Future Outlook: Innovation, Resilience, and Cooperation

Looking forward, the semiconductor industry faces three intertwined imperatives:

- Sustained Innovation: As Moore’s Law slows, new approaches such as chiplet architectures, advanced packaging, and novel materials (like graphene or 2D semiconductors) are needed to keep progress alive.

- Supply Chain Resilience: Diversifying production geographically, improving inventory strategies, and fostering transparent cooperation among allies will be critical.

- International Cooperation vs. Fragmentation: While geopolitics often pushes toward rivalry and protectionism, the semiconductor ecosystem’s interdependence suggests that global cooperation remains the most efficient—and arguably necessary—path.

Conclusion: A Strategic Technology for an Uncertain World

The history of semiconductors is the story of human ingenuity transforming physics into progress. Yet it is also the story of strategic competition and the fragility of global interdependence. As the world faces new challenges—climate change, cybersecurity threats, and even future pandemics—semiconductors will remain the backbone of innovation and the focal point of geopolitical rivalry.

The rise of semiconductors shows that technological breakthroughs cannot be separated from political and economic contexts. Understanding this intertwined history is essential not only for policymakers and industry leaders but also for anyone who seeks to grasp the forces shaping the 21st century.