Introduction: The Changing Landscape of Global Monetary Policy

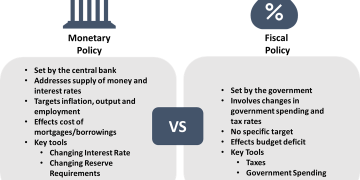

As the world economy becomes more interconnected and dynamic, the role of global monetary policy is also evolving. Central banks are facing a new set of challenges, ranging from the rise of digital currencies to increasing geopolitical uncertainties and the need for sustainable economic growth. The traditional tools of monetary policy are being stretched to their limits, and new instruments and frameworks are being explored.

This article examines the future of global monetary policy by exploring emerging trends, potential challenges, and new opportunities. We will look at how central banks are adapting to new economic realities and how their policies will shape the future of the global economy.

Section 1: The Rise of Digital Currencies and Their Implications

One of the most significant developments in recent years has been the rise of digital currencies. While cryptocurrencies like Bitcoin and Ethereum have garnered significant attention, central banks are now exploring the possibility of issuing their own digital currencies, known as Central Bank Digital Currencies (CBDCs).

The Concept of Central Bank Digital Currencies (CBDCs)

A Central Bank Digital Currency is a digital form of a country’s fiat currency that is issued and regulated by the central bank. Unlike cryptocurrencies, which are decentralized and rely on blockchain technology, CBDCs are centralized and are backed by the full faith and credit of the issuing government.

Several countries, including China, Sweden, and the Bahamas, have already launched or are piloting their CBDCs. The People’s Bank of China, for instance, has been testing its digital yuan, which has the potential to transform the way payments are made both domestically and internationally.

Potential Benefits of CBDCs

The adoption of CBDCs offers several potential benefits:

- Increased Efficiency: CBDCs can streamline the payment process, reducing transaction costs and eliminating the need for intermediaries. This could make cross-border payments faster and cheaper, especially in emerging markets.

- Financial Inclusion: By offering digital currencies, central banks could provide a low-cost alternative for people who are unbanked or underbanked, enabling them to access financial services using smartphones or other digital platforms.

- Enhanced Monetary Policy Tools: Central banks could potentially use CBDCs to implement more effective monetary policies. For example, CBDCs could allow for direct stimulus payments to citizens or more targeted interest rate policies through digital wallets.

Challenges and Risks of CBDCs

Despite their potential benefits, CBDCs also present several challenges and risks:

- Privacy Concerns: CBDCs could raise significant concerns about privacy, as governments and central banks would have the ability to track every transaction. This could lead to fears of government overreach and data misuse.

- Disintermediation of Commercial Banks: If people begin to hold digital currencies directly with central banks, commercial banks could lose depositors and the ability to lend. This could undermine the traditional banking system and reduce the effectiveness of monetary policy.

- Cybersecurity Threats: As with any digital infrastructure, CBDCs would be vulnerable to cyberattacks. A breach in a national digital currency system could have severe consequences for financial stability and public confidence.

Section 2: The Influence of Globalization on Monetary Policy

In today’s globalized economy, central banks no longer have control over the domestic economy in isolation. Events in one part of the world can have far-reaching effects on other countries. As such, the interconnectedness of the global economy presents both opportunities and challenges for monetary policymakers.

The Global Transmission of Monetary Policy

One of the primary effects of globalization on monetary policy is the transmission of policy actions across borders. Central banks must take into account not only domestic economic conditions but also the global economic environment. For example, interest rate changes in the United States can affect investment decisions and exchange rates in other countries, especially those with close trade or financial ties to the US.

The Federal Reserve’s interest rate decisions often influence capital flows, currency values, and stock market movements across the globe. Central banks in emerging markets, for example, may face challenges if their domestic currency weakens in response to a rate hike in the US. In such cases, emerging market central banks may feel compelled to raise their own rates to defend their currency, even if their domestic economy is weak.

The Role of Global Institutions in Monetary Policy Coordination

In light of these global interdependencies, international cooperation between central banks has become increasingly important. Institutions like the International Monetary Fund (IMF) and the Bank for International Settlements (BIS) facilitate dialogue and coordination between central banks to prevent market disruptions and ensure the stability of the global financial system.

The global financial crisis of 2008 highlighted the importance of central banks working together. During the crisis, central banks in developed economies coordinated their monetary policies, including interest rate cuts and liquidity injections, to stabilize financial markets.

In the future, continued collaboration will be critical as economies become more interconnected and new challenges—such as climate change and digital currencies—emerge.

Section 3: Challenges of Low Interest Rates and the Limits of Traditional Monetary Policy

One of the most persistent challenges central banks face today is the limitation of traditional monetary policy tools. For the better part of the last decade, central banks in developed economies have kept interest rates at historically low levels, struggling to stimulate economic growth in the aftermath of the global financial crisis.

The Zero Lower Bound (ZLB)

The concept of the zero lower bound refers to the situation where short-term nominal interest rates are close to zero, rendering traditional monetary policy ineffective. Once interest rates hit zero, central banks cannot lower them further to stimulate the economy. This is a critical problem, as it limits the central bank’s ability to combat recessions or deflation.

To address this issue, central banks have resorted to unconventional monetary policies such as quantitative easing (QE), forward guidance, and negative interest rates. However, the effectiveness of these policies has been debated, and their long-term consequences are still uncertain.

The Risk of Asset Bubbles

One of the unintended consequences of prolonged low interest rates is the potential for asset bubbles. With cheap money readily available, investors may drive up the prices of assets, such as real estate, stocks, and bonds, beyond their intrinsic value. This can lead to financial instability and increase the risk of sudden market corrections.

In addition, low interest rates can exacerbate income inequality. Wealthier individuals and institutions tend to benefit the most from rising asset prices, while those without significant investments may see little benefit from low rates.

The Need for New Policy Tools

As the limits of traditional monetary policy become increasingly apparent, central banks are exploring new tools to address these challenges. Central bank digital currencies (CBDCs), as discussed earlier, may offer a way for central banks to implement more direct forms of monetary stimulus, such as digital cash transfers to citizens.

Furthermore, fiscal-monetary coordination—where central banks work closely with governments on stimulus efforts—may become more common. This could involve central banks supporting government spending programs or directly funding infrastructure projects to stimulate growth.

Section 4: Climate Change and Its Impact on Monetary Policy

Another emerging challenge for central banks is the growing importance of climate change in shaping economic policies. The transition to a low-carbon economy and the financial risks posed by climate change are prompting central banks to reassess their roles and responsibilities.

Integrating Climate Risk into Monetary Policy

Central banks are increasingly aware of the risks that climate change poses to financial stability. These risks can take two forms: physical risks and transition risks. Physical risks refer to the damage caused by extreme weather events, such as floods, storms, and wildfires, which can disrupt supply chains, destroy infrastructure, and harm businesses.

Transition risks, on the other hand, arise from the shift to a low-carbon economy. As countries implement policies to reduce carbon emissions, industries reliant on fossil fuels may face financial losses, which could ripple through financial markets.

Central banks are beginning to incorporate climate-related risks into their financial stability assessments. The Bank of England, for example, has set up a climate stress-testing framework for banks to assess their exposure to climate risks. Similarly, the European Central Bank (ECB) has committed to integrating climate risks into its monetary policy operations.

The Role of Green Bonds and Sustainable Finance

One of the ways central banks are responding to climate change is by encouraging the development of sustainable finance. Green bonds, which are used to fund environmentally sustainable projects, are becoming an important asset class. Central banks may purchase these bonds as part of their monetary policy operations, thereby supporting the transition to a green economy.

Moreover, central banks are also exploring how to align monetary policy with climate goals. This may include incorporating climate change considerations into the collateral that central banks accept in their operations, or adjusting their interest rates in ways that incentivize investment in sustainable projects.

Conclusion: Navigating the Future of Global Monetary Policy

The future of global monetary policy is complex and uncertain. As central banks face new challenges, such as the rise of digital currencies, low interest rates, and the impacts of climate change, they will need to adapt their tools and strategies. Collaboration between central banks and international financial institutions will be key in managing these challenges and ensuring the stability of the global economy.

While traditional monetary policy tools are still relevant, central banks must also embrace innovation and explore new ways to promote financial stability, sustainable growth, and inclusive prosperity in an ever-changing global landscape.